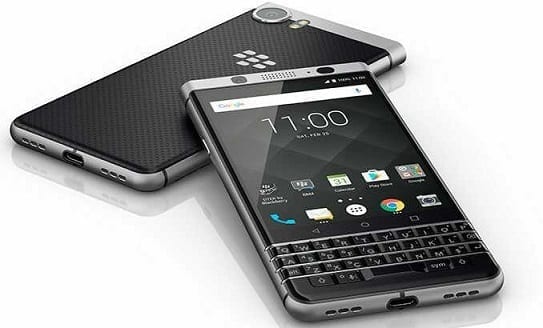

BlackBerry KeyOne is the latest BB phone from TCL. It is the first BlackBerry phone since the

PRIV and the first from TCL to feature a physical QWERTY keyboard. BlackBerry KeyOne has a 4.5-inch display and runs on Android 7.1.

Where to Buy BlackBerry KeyOne

BlackBerry KeyOne Key Specs & Features

- 4.5-inch IPS Display, 1080 x 1620 pixels (434ppi)

- Four-Row Physical QWERTY Keyboard

- 2.0GHz Octa-core Qualcomm Snapdragon 625 CPU with 3GB RAM

- Android 7.1 (Nougat) with DTEK Security Software

- 32GB Storage with support for memory card up to 256GB

- 12MP Rear Camera and 8MP Front Camera

- 4G LTE (up to 450 Mbps download)

- Fingerprint Sensor (Front)

- 3505 mAh Battery with Fast Charging

Design, Display, Cameras

BlackBerry KeyOne features the same touchscreen and physical QWERTY keyboard combo of the

BlackBerry Priv. However, the keyboard does not slide-in like in the later.

This rigid keyboard design results in a much smaller screen in order to accommodate the QWERTY keys. BlackBerry KeyOne has a 4.5-inch IPS display with 1080 x 1620 pixels resolution.

The display is covered in Corning Gorilla Glass 4. The four-row physical QWERTY keyboard is located below the screen with the space bar of the keyboard also doubling as a fingerprint sensor.

BlackBerry KeyOne has a 12 megapixel camera on the back (Sony Sensor) and an 8 megapixels camera on the front. The rear camera features Phase Detection autofocus, dual-tone LED flash, HDR, Panorama, and Face Detection.

Both cameras record 1080p HD videos.

Hardware & Software

BlackBerry KeyOne runs Android 7.1 (Nougat) on the 2GHz octa-core Qualcomm Snapdragon 625 chipset with 3GB RAM. The Android smartphone sports 32GB built-in storage with support for up to 256GB memory card.

BlackBerry KeyOne supports dual-band Wi-Fi, Bluetooth 4.2, USB Type C, and NFC. The phone support download speeds of up to 450Mbps on 4G LTE with most LTE bands supported depending on region or country. In Nigeria it supports all the 4G networks including MTN, Etisalat, Glo, NTel, Smile, and InterC.

BlackBerry KeyOne is pre-loaded with the DTEK security software that was made popular by earlier phones by TCL like the

BlackBerry DTEK50 and

BlackBerry DTEK60. While TCL did the design and build, BlackBerry focused on the software.

Pricing and availability

BlackBerry KeyOne will launch on April 2017 starting at a price of around $549. We currently have no data on pricing and availability for Nigeria, Ghana, or Kenya. When available, you can buy the smartphone at leading online stores in the countries. BlackBerry KeyOne Price in Nigeria is expected to range from 195,000 Naira to 300,000 Naira depending on your location in the country.

BlackBerry KeyOne Specs

Here are a few specs of the BlackBerry KeyOne:

General Features

- Platform: Android 7.1 (Nougat)

- Processor: 2.0GHz Octa-core Processor (Qualcomm Snapdragon 625)

- GPU: Adreno 506

- Memory: 3GB RAM

- Colours: Black

- Dimension: 149.1 x 72.4 x 9.4 mm

- Weight: –

- SIM Type: Nano-SIM

- SIM Count: Single SIM

Display

- Display: 4.5-inch IPS Display, 1080 x 1620 pixels (434ppi)

- Screen Protection: Corning Gorilla Glass 4

Camera

- Rear Camera: 12 MP Camera, 1080p HD Video

- Rear Camera Features: dual-LED Flash, HDR, PDAF Autofocus, Geo-tagging, Face Detection, Panorama

- Front Camera: 8 MP Camera, 1080p HD Video

Storage

- Built-in Storage: 32GB

- Memory Card Support: Yes, up to 256GB Storage

- Bundled Cloud Storage: –

Network Support

- 2G GSM: 850 / 900 / 1800 / 1900MHz

- 2G CDMA 1X: No

- 3G WCDMA: 850 / 900 / 1900 / 2100MHz

- 3G CDMA EVDO: No

- 4G LTE: Yes, LTE band 1(2100), 2(1900), 3(1800), 4(1700/2100), 5(850), 7(2600), 8(900), 13(700), 17(700), 20(800), 28(700), 38(2600), 40(2300) [EMEA], LTE band 1(2100), 2(1900), 3(1800), 4(1700/2100), 5(850), 7(2600), 12(700), 13(700), 20(800), 25(1900), 26(850), 28(700), 29(700), 30(2300), 41(2500) [United States v2], LTE band 1(2100), 2(1900), 3(1800), 4(1700/2100), 5(850), 7(2600), 8(900), 12(700), 13(700), 17(700), 19(800), 20(800), 28(700), 29(700), 30(2300), 38(2600), 39(1900), 40(2300), 41(2500) [Canada, LATAM, APAC, US v1]

Internet & Connectivity

- GPRS: Yes, up to 48kbps

- EDGE: Yes

- 3G/WCDMA/HSPA: Yes, up to 21Mbps

- HSPA+: Yes, up to 42Mbps

- CDMA EVDO: No

- 4G LTE: Yes, up to 450Mbps

- WLAN: Wi-Fi 802.11 a/b/g/n/ac, Dual-Band, Wi-Fi Direct

- Wi-Fi Hotspot: Yes

- Bluetooth: Yes, Bluetooth 4.2 with A2DP, LE, EDR

- NFC: Yes

- Infrared Blaster: No

- USB Port: Yes, USB Type C, USB on the Go

Messaging

- SMS/MMS: Yes

- Instant Messaging: Yes

- Push Emails: Yes

- Email Protocol: IMAP4, POP3, SMTP

Entertainment

- Music Player: Yes, mp3, WAV, FLAC, eACC+

- Video Player: Yes, MPEG4, H.263, H.264, XviD

- FM Radio: Yes

- Loudspeaker: Yes (Stereo)

- 3.5mm Jack: Yes

Navigation

- Navigation: Yes, GPS with A-GPS, GLONASS

- Maps: Yes, Google Maps

Sensors & Control

- Digital Compass: Yes

- Accelerometer: Yes

- Proximity Sensor: Yes

- Light Sensor: Yes

- Barometer: No

- Pedometer: –

- Heart Rate Monitor: No

- Gyroscope: Yes

- Fingerprint Scanner: Yes (Rear)

- Iris Scanner: No

- Intelligent Digital Assistant: Yes

- Motion Sensing / Gesture Control: Yes

- Voice Control: Yes

Other Features

- Video Streaming: Yes

- Physical QWERTY Keyboard: Yes, 4-row QWERTY keyboard

- Active Noise Cancellation: Yes (with dedicated mic)

- Built-in Mobile Payment: –

- Wireless Charging: No

- Water Resistant: No

- Dust Resistant: No

- Image Editor: Yes

- Video Editor: Yes

- Document Viewer: Yes

- Document Editor: No (download at store)

Battery

- Battery: 3505 mAh Li-ion Battery (non-removable)

- Talktime: –

- Standby Time: –

- Fast Charging: Yes (Quick Charge 3.0), charge to up to 50% in 36 minutes

Source: naijatechguide